Before launching LIFE‑AR in 2018, the LDC Group undertook a thorough analysis of the long-standing barriers to accessing climate finance. Despite increasing global commitments, adaptation finance remained insufficient, unpredictable, and risk-averse, with only a fraction reaching the countries and communities that need it most—less than 5% of public adaptation finance reached LDCs between 2016 and 2021. Funding that does exist is often short-term, top-down, fragmented, and poorly aligned with local priorities, while local systems lack the capacity to manage large-scale, sustained financial flows. As a result, many communities are not benefiting from climate action. To address this, a fundamental shift is needed—towards predictable, locally-led finance systems that can build long-term resilience through truly transformative, country-driven approaches.

Finance underpins power structures – rigid reporting structures, strict terms and conditions, inflexible budgets and logic models. The LIFE-AR Finance Ask is designed as a collective mechanism to deliver adaptation finance in ways that are predictable, flexible, and locally led. The long-term vision is for LDCs to access and direct climate finance in support of their own priorities. This entails access to long term and predictable funds that enable scale up and scale out. Core principles include pooled funding, investment in governance and systems first, and full country ownership and leadership.

LIFE-AR also aims to build the capabilities of LDCs to access and manage large sums and channel them effectively to the local level, thereby reducing the need for financial intermediaries - as well as challenging rules and power dynamics.

" We will develop strong climate finance architecture, with at least 70% of flows supporting local-level action by 2030 "

LIFE-AR aims to break away from the top-down, rigid, and predetermined funders’ priorities to supporting LDCs’ locally-led and identified climate priorities.

At the global level, this ambition is operationalised through four major innovations: the pooled fund mechanism, flexible budgeting, patient funding and setting the ground for investing 70% of climate funds behind locally prioritised investments.

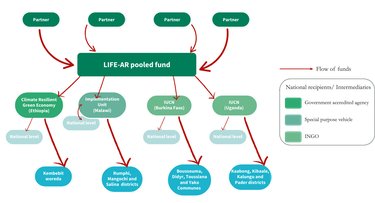

Perhaps LIFE-AR’s most striking achievement is the creation of a pooled fund. This allows the initiative to move beyond the fragmented model where each development partner requires separate reports. By pooling resources, LIFE-AR has broken one important link in the chain of development partner control – LDC priorities now drive investments. Credit must go to progressive partners who have been open to this operating model. Some partners have had specific requirements around reporting, or operational models that don't fund countries directly. However, it has been a process of learning, dialogue and improvement for both LDCs and partners.

The pooled fund is governed by Standard Operating Procedures (SOP) negotiated between the Secretariat, the Board, and the development partners. The funds are allocated to specific budget lines and LIFE-AR/ IIED commits to ensure fiduciary responsibility to protect those funds and to use them for impact and good value for money. The Board approves budgets based on country needs, and once country budgets are approved, decision-making power rests firmly in the hands of the countries themselves.

The SOP notes that funding should be negotiated on a multi-year basis so LDCs can invest in longer-term activities. There are still challenges as not all development partners have committed to multi- year funding, and some grants are done year on year – which can undermine predictability and leave LIFE-AR still exposed to bilateral negotiations, opt-outs, and short funding cycles. .

Development partners have agreed to simplify budget revision approval processes, enabling countries to reallocate budgets as priorities evolve. This trust-based approach represents a global-level innovation, replacing top-down command-and-control programme design with adaptive planning, and allowing countries to respond to real-time changes in their contexts and priorities.

Development partners committed to support LIFE-AR Establishment phase which took more than 2 years due to the COVID pandemic. Acknowledgement that investing in local governance, system design, and capacity-building is a legitimate and necessary use of climate finance is key to sustainable climate action that is country led. The Establishment phase allowed deliberate design, institution-building, and strengthening governance structures. This slower approach has sometimes made progress seem “invisible” through the business-as-usual reporting lens, while creating an enabling environment for long term investment. .

Inspired by the Devolved Climate Finance mechanisms, the 70% target ensures that climate finance reaches local communities. The remaining 30% supports critical functions for maintaining integrity and effectiveness of the initiative, like capacity building, training, monitoring and evaluation, planning, and compliance.

LIFE-AR countries are developing governance systems that can channel funds effectively to the local level. These systems are designed to be scalable and integrated into existing national frameworks, enabling long-term sustainability. As financing volumes increase, the relative cost of operating these mechanisms decreases, leading to lower proportional overhead costs.

The 70% goal can be tracked both at the country level and across the initiative. Lessons from budgeting using 70/30 have been documented across countries and will be shared in an upcoming paper.

LIFE-AR countries have discretionary authority over how their funds are used (with one exception, see below). The Secretariat provides guidance and advice, ensuring minimum compliance. This autonomy has allowed countries to shape their own pathways, from deciding how to set up and finance their national platforms, to raising awareness and building capacity, to determining which aspects of Business Unusual to prioritise, and whether or not to rely on consultants.

Yet in the drive to prioritise specific ‘Offers’ and objectives, countries sometimes underfund essential functions such as capacity building, MEL systems, learning loops and knowledge management. These gaps can create systemic weaknesses that undermine the initiative’s collective progress. LIFE-AR countries recognised that strengthening peer-to-peer review and more targeted Secretariat guidance, rooted in real examples, could be useful so that early choices do not create future vulnerabilities.

The vision underpinning LIFE-AR is clear: LDCs should be able to access climate finance on their own terms, through systems that are integrated into government processes. In practice, development partner concerns about fiduciary risk meant that, except for Bhutan, it was not possible to channel LIFE-AR funds directly into national treasuries during the Establishment phase. Countries were required to nominate a non-governmental intermediary to act as fund manager, which were confirmed after a rigorous Board-approved due diligence assessment.

The experience of using fund managers has been mixed.

On the one hand, the costs of fund managers are considerable, consuming scarce resources, while procurement rules can be restrictive, and disbursements delayed. Changing intermediaries create additional financial and operational burdens: new due diligence procedures, loss of institutional memory, and need to build new working relationships.

On the other hand, fund managers can be effective members of the national platform, increasing coordination between actors, plugging capacity gaps and helping to build LDC capacity to get funds to the local level.

During the Establishment Phase, LDCs experimented with models to build pathways towards financial sovereignty.

For example, Malawi focused their efforts on creating the Implementation Unit (IU) to manage funds and support delivery. The IU sits within the Ministry of Environmental Affairs, with oversight from development partners and government. Its co-design process was lengthy with significant opportunity costs. Today, the IU, is positioned as Malawi’s fund manager, building institutional capacity, creating a track record for handling funds and moving Malawi closer to direct access.

In Ethiopia, the initiative has explored the option of using accredited institutions within Government, who have gone through due diligence processes of international funding entities. The Climate Resilient Green Economy (CRGE) facility is now responsible for channeling LIFE-AR funds, with reduced external institutional policies, approvals and other bureaucracies leading to delays.

‘We chose IUCN as our fund manager. We already have so many initiatives and projects in which the IUCN is involved, so this made everything straightforward. And IUCN has an established track record of transferring funds to local government. ’

Marthe Ky Baro, LIFE-AR Burkina Faso, Focal Point

To channel 70% of LIFE-AR climate funds to the local level, countries have chosen a delivery mechanism based on existing decentralised government processes, reflecting a preference for sub-national administrations managing budgets. LIFE-AR national platforms have worked with local governments to establish participatory processes to ensure communities’ decision-making role in the way LIFE-AR adaptation investments were designed and selected.

The 70 percent commitment is a trajectory rather than an immediate output, as the Establishment phase involved spending on governance, systems design, and institutional architecture. Countries retain flexibility in how they classify expenditure: some view district-level governance as part of the 70%, others as part of the 30%.

As LIFE-AR moves into the Test and Evolve phase, real expenditure data brings sharper scrutiny to these classifications. Peer learning and iterative Board guidance will be needed to interpret grey areas without undermining national ownership.

Climate Finance Governance at the Platform Level. The pooled fund and flexible budgeting remain considerable achievements for LIFE-AR. A key challenge is to consolidate these gains, expand development partner confidence in the pooled fund, and continue to demonstrate that patient investment in systems and governance is the only path to achieving the 70% ambition by 2030. The planned transition to the independent LIFE-AR Facility provides an opportunity to continue strengthening LDC institutions and capacities and to enable development partners to broker long term, quality finance for the LDCs.

External Fund Managers.For LDCs, choosing a financial intermediary is a strategic decision. Frequent changes of intermediary are expensive and disruptive. LDCs also need to consider whether moving away from fund managers is a priority. Alternative pathways exist (e.g. setting up a Special Purpose Vehicle) but can be time-consuming.

For development partners, the benefits and the costs for LDCs of working with intermediaries should be recognised. They can be valuable tools for capacity-building and for managing risks, but they come with heavy operational costs and delays.

For LIFE-AR, the challenge lies in ensuring robust and efficient oversight. Streamlining due-diligence procedures and fast-tracking agencies already accredited with international climate funds could reduce costs and delays. Administrative cost implications for the initiative should also be considered: while less experienced fund managers may require supervision; likewise, the setup of special purpose vehicles require specialised technical support.

The 70:30 Target. The 70% target captures the novelty of LIFE-AR while remaining flexible enough to allow countries to interpret it in ways that match their contexts. The Establishment phase provided LDCs with the opportunity to be ambitious about business unusual financial system design and governance. The long term 70:30 Finance principle is achievable depending on increase in fundings to cover fixed administrative costs. The target also allows the Secretariat and Board to hold both development partners and LDCs accountable – calling on development partners to increase quality finance coming to the LDCs while tracking the flow of funds to the local level.

‘The 70% to the local level target is really getting attention in The Gambia. It’s a new approach and makes LIFE-AR stand out as an initiative.’

Modou Cham, LIFE-AR The Gambia, Focal Point

LIFE-AR is bringing business unusual climate finance to life. Now that delivery mechanisms are in place and the systems are being tested and perfected, LIFE-AR will use the emerging evidence base and the building momentum to push for realistic, targeted reforms in multilateral funding agencies and development partners.