Author: Tracy Kajumba, LIFE-AR Director

As the UNFCCC COP30 approaches in Belém, Brazil, country platforms have gained renewed attention across climate finance discussions. The UNFCCC, Multilateral Development Banks (MDBs), and the G20 called for expanding the concept, and Brazil and South Africa have used their respective COP30 and G20 presidencies to enhance cross learning and launch a new generation of platforms.

The COP30 Circle of Finance Ministers launched its report with contributions to the Baku–Belém Roadmap in Washington, DC, highlighting five areas including creation of country platforms and strengthening of domestic capacity to attract sustainable investments, as a roadmap to mobilize $1.3 trillion annually by 2035.

But amidst the excitement, a critical question remains.

Are the country platforms truly shifting power or simply optimizing systems that were never built for equity?

Country platforms have capacity to align diverse funding sources behind national climate priorities, reduce fragmentation, and improve coordination. From the Bangladesh Climate and Development Partnership to the Just Energy Transition Partnerships (JETPs) in South Africa, Vietnam, Indonesia, and Senegal, we have seen promising examples emerge. These platforms blend loans and grants, support sectoral transitions, and aim to scale climate action.

Yet, most platforms still operate within donor-recipient frameworks that reinforce existing inequities. Studies show that climate finance continues to flow primarily to the most bankable, lowest risk, highest return projects, often in middle-income countries, leaving Least Developed Countries (LDCs) behind.

The examples of country platforms are largely focusing on middle income countries and convened by the global north with less LDC representation. The result? Hopefully a more coordinated architecture, but not a more just and inclusive one.

LIFE-AR has been working on governance systems including setting up national platforms, albeit with less visibility, but with documented examples in this publication.

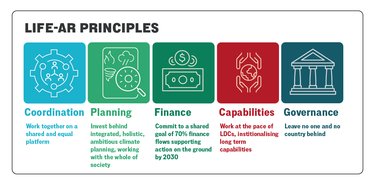

LIFE-AR’s national platforms are designed by and for LDCs, guided by principles that challenge conventional thinking and place countries and communities at the center of climate finance delivery. These platforms are not donor-driven, they are governed and implemented by LDCs, rooted in local realities and long-term vision.

The six LIFE-AR Front Runner Countries, Bhutan, Burkina Faso, Ethiopia, Malawi, The Gambia, and Uganda are demonstrating what country platforms can achieve. A second cohort is now developing theirs. All are building track records in effective finance delivery, gender and social inclusion, learning, and long-term sustainability.

Coordination without shifting power will not deliver meaningful results. Real transformation requires confronting the power dynamics that have kept climate finance locked in donor driven cycles. LIFE-AR’s partnership compact redefines relationships between LDCs and stakeholders moving from consultation to co-design, from participation to genuine partnership.

Countries and communities must be decision makers, not just beneficiaries. Locally-led adaptation principles emphasize patient, predictable funding and investment in local capabilities. LIFE-AR operationalizes this at scale, showing that community leadership isn’t just possible, it’s essential.

Strengthening systems and capabilities is part of climate action. Building knowledge, skills, and institutions is as critical as funding adaptation projects. LIFE-AR’s long-term strategy lays the foundation for countries to access diverse funding sources independently, reducing over reliance on traditional donor channels. However, this takes time and sustained investment.

Country platforms must build evidence to demonstrate effectiveness. LIFE-AR follows a phased approach: Establishment to strengthen governance, Test and Evolve to refine delivery mechanisms, and Scale Up to enable learning and proof of concept. The LDC communities of practice share lessons across countries, building collective expertise and momentum.

As COP30 advances, the climate finance actors must ask themselves: Will we keep refining coordination within existing power structures? or embrace transformative models that shift power, build capabilities, and deliver finance where it’s needed most? The LDC Group is already on this path.

Seizing this moment requires confronting hard questions: Who sets priorities? Who makes decisions? Who benefits? LIFE-AR is beginning to show what’s possible when we design backwards from genuine country ownership, informed by real barriers to accessing climate finance.

For donors and development partners, this means moving beyond efficiency to equity. Streamlined processes that ignore power dynamics won’t deliver. Equity demands shifting decision making authority to the countries and communities most affected by climate change.

For multilateral institutions, it means recognizing that coordination is not just technical, it’s political. Aligning finance with national priorities requires navigating governance structures and historical imbalances to build trust.

For private investors, it means seeing locally owned solutions as both ethical and effective. LIFE-AR’s 70/30 principle to channel finance to locally prioritized investments reduce risk and improves long term outcomes both social, environmental, and financial.

The climate crisis won’t wait for us to get comfortable with business unusual. We’re racing against time. Radical disruption is needed, along with the courage to innovate, fail, and learn.